Are you looking for expert advice on how to manage your investments best? If so, you've likely come across the two leading players in the world of automated investment services: Wealthfront and Vanguard Personal Advisor Services (Vanguard PAS). Both are designed to help you create a personalized financial plan that meets your individual goals and needs. But which one is right for you?

In this blog post, we dig into each service's features, advantages, disadvantages, and cost structure – to help determine if Wealthfront or Vanguard PAS is better suited for your specific financial situation. Keep reading to learn more.

Wealthfront Introduction

Wealthfront is an automated investment service that offers investors instant access to a portfolio of diversified investments managed by their advanced, proprietary software. Utilizing sophisticated algorithms, Wealthfront simplifies the process of creating and managing a personalized financial plan.

Vanguard Introduction

Vanguard Personal Advisor Services (Vanguard PAS) provides a more hands-on approach to managing investments. Working with Vanguard's team of financial professionals, you are assigned a dedicated advisor who will create a customized plan for your individual needs and goals. This personalized service offers ongoing guidance and support throughout the investment process.

Comparing Wealthfront & Vanguard PAS

When comparing Wealthfront and Vanguard PAS, it's important to consider your individual needs. Are you looking for a hands-on approach with personalized advice and support? Or do you prefer an automated service that offers efficient portfolio management without human intervention?

Wealthfront is an ideal solution for those who prefer a more automated approach and don't require the personalized attention of a financial advisor. It offers access to diversified investments, advanced risk-reduction strategies, and tax optimization tools.

Vanguard PAS has been designed for investors who value a more personal approach and benefit from guidance and advice to make informed decisions. In addition to portfolio management, Vanguard PAS offers access to a team of financial advisors who can answer questions, provide insights and offer personalized advice tailored to your individual goals.

Cost Structure

Wealthfront and Vanguard PAS charge an annual management fee based on your account's total value. Wealthfront charges a flat annual fee of 0.25% for accounts up to $10,000 and reduces its fees as your balance grows, making it an ideal choice for investors with fewer assets.

Vanguard PAS's annual management fee increases with your account size and can range from 0.30% to 0.90%, making it more suited for investors with larger accounts and more complex needs.

Wealthfront vs. Vanguard: Services & Features

In addition to portfolio management and a range of diversified investments, Wealthfront and Vanguard PAS offer additional features that can help you take control of your financial future.

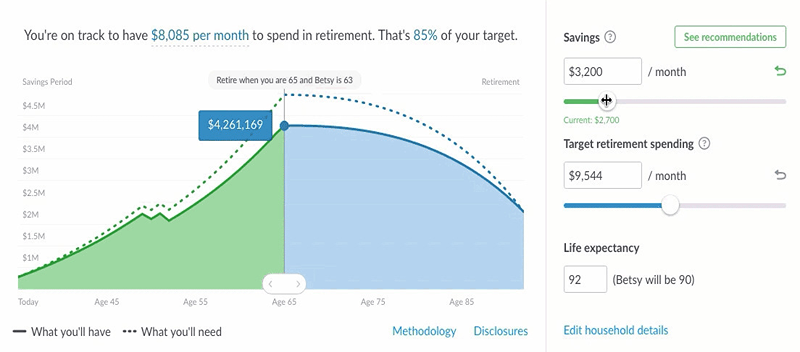

Wealth front's automated investment service includes access to 401(k) rollover services, estate planning tools, tax optimization strategies, and retirement calculators – all tailored to your individual goals.

Vanguard PAS offers access to planning services such as retirement and wealth management, free webinars, and a library of investor resources. They also provide advice on insurance options and real estate investments, helping you make the most of all aspects of your financial life.

Wealthfront vs. Vanguard: Online & Mobile Experience

Finally, when considering Wealthfront or Vanguard PAS, it's important to factor in the online and mobile experiences. Both services offer a user-friendly interface allowing you to access your account information anywhere.

Wealthfront offers an intuitive online dashboard and comprehensive mobile apps for iOS and Android devices. These apps provide access to real-time investment performance, personalized alerts and notifications, and the ability to adjust your asset allocation quickly and easily.

Vanguard PAS's online platform lets you view your portfolio performance and make changes from any device. They also offer a mobile app for iOS devices with features such as account management, secure messaging, and access to financial research.

Wealthfront vs. Vanguard Reddit

Wealthfront and Vanguard Personal Advisor Services (Vanguard PAS) are two of the most popular automated investment services. They offer investors a personalized financial plan tailored to their individual goals and needs. But which one should you choose?

Wealthfront VS Vanguard Reddit

Wealthfront and Vanguard are two of the most well-known and respected financial services providers in the U.S., offering various products and services to help individuals save for retirement, build wealth, and manage their investments. Wealthfront is an online robo-advisor that provides low-cost investment management. At the same time, Vanguard is a full-service investment advisor with a team of experts to help clients manage their portfolios.

Which is the best option: Wealthfront vs. Vanguard Personal Advisor Services? It all depends on your goals and needs as an investor. Wealthfront may be a good choice for low-cost, automated investing with access to sophisticated algorithms. Meanwhile, Vanguard's Personal Advisor Services may be a better fit for those who want more personal guidance and advice.

Final Verdict

When choosing between Wealthfront or Vanguard PAS, there needs to be more than a one-size-fits-all solution. Your individual needs and goals should always come first when deciding your investments.

That said, Wealthfront and Vanguard PAS offer great features and services tailored to various investor profiles. Consider how each service will meet your needs before making your final decision.

FAQs

How does Wealthfront stack up against Vanguard PAS?

Both services offer personalized financial advice but in different ways. Wealthfront focuses on automated investment management with an emphasis on low-cost index funds. At the same time, Vanguard Personal Advisor Services (Vanguard PAS) offers a more comprehensive suite of services that includes tax optimization and goal tracking.

What are the costs associated with each service?

Both Wealthfront and Vanguard PAS have different pricing structures. Wealthfront charges 0.25% of assets managed, while Vanguard PAS has two pricing tiers: 0.30% for accounts up to $50,000 and 0.20% for accounts over $50,000.

Which service offers more personalized advice?

Vanguard PAS provides a deeper level of personalization through its team of financial advisors. These advisors work with you to create a customized plan that focuses on your individual goals and needs, along with tax optimization and goal tracking. Wealth front's automated approach is still very personalized but may have a different depth than Vanguard PAS.

Which service has better investment options?

Wealthfront and Vanguard PAS offer a variety of low-cost index funds, but each has its own set of advantages. Wealthfront offers a wider selection of investments, including more strategic asset allocation models and tax-loss harvesting for taxable accounts.

What are the advantages of each service?

Wealth front's chief advantage is its automated investing platform, which requires less work from the investor and makes it easy to manage investments cost-effectively. Vanguard PAS also offers automation but provides additional services such as tax optimization, goal tracking, and access to financial advisors for more comprehensive advice.

Is my money safe with Wealthfront?

Yes, Wealthfront is a registered investment adviser who has put in safeguards to ensure your money is safe. Your account is also protected by the Securities Investor Protection Corporation (SIPC) up to $500,000.

Is my money safe with Vanguard PAS?

Yes, your money is safe with Vanguard PAS as it is also a registered investment adviser and has put in safeguards to protect your money. Your account is protected by the Securities Investor Protection Corporation (SIPC) for up to $500,000.

Conclusion

When deciding between Wealthfront and Vanguard PAS, it all comes down to your situation and needs. Both services offer low-cost index funds and automated investing capabilities. Still, Vanguard PAS has the added benefit of providing a deeper level of personalization with its team of financial advisors. Ultimately, it would help if you decided on a service that meets your specific goals and needs while keeping costs low.